|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

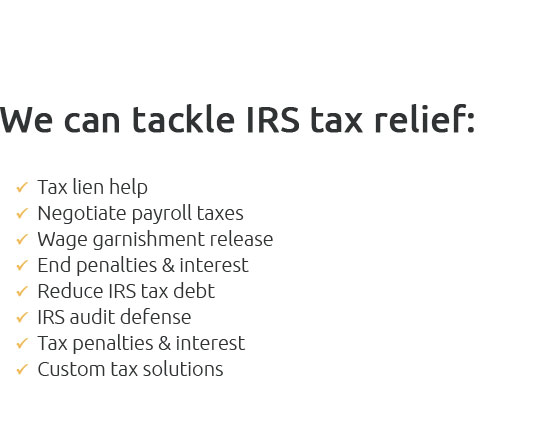

Struggling under the weight of tax debt can feel like an endless uphill battle, but with our expert tax debt attorneys by your side, relief is within reach-imagine a world where your IRS burdens melt away, thanks to the strategic power of the IRS debt forgiveness form, meticulously navigated by professionals who turn complex tax codes into opportunities for your fresh start; don't let tax debt dictate your future when our proven solutions are just a call away, ready to transform your financial landscape with confidence and clarity.

https://www.hrblock.com/tax-center/irs/forms/1099c-cancellation-of-debt/?srsltid=AfmBOoqtLDCVSMvL76OoJhXZCokHusbuh4QviasOhXPm2yBFZoNpcngn

The federal government agency or an applicable financial institution (a creditor) will send a 1099 C form when the lender discharged (canceled or forgiven) debt ... https://www.irs.gov/pub/irs-pdf/f1099c_14.pdf

You received this form because a Federal Government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven) a debt you owed, ... https://www.irs.gov/pub/irs-pdf/f1099c.pdf

You received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven) a debt you owed, ...

|